Who needs a Short Sale Information Packet?

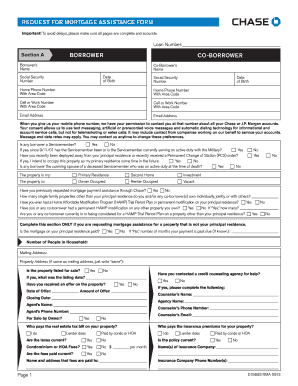

JPMorgan Chase — is one of the biggest banks in the world. The Short Sale Information Packet should be filled out for evaluation of the applicant’s Short Sale request.

What is the Short Sale Information Packet for?

The Chase Short Sale Information Packet contains the following:

-

Required documentation checklist — detailed list of the documents an applicant must send to the Chase in addition to the packet;

-

Authorization to Provide and Release Information ?? Grants ts Chase permission to provide information pertaining to your mortgage to necessary agents;

-

Request for Consideration of Short Sale — information about the applicant’s property, loans, income, etc.

-

IRS Form 4506T-EZ Request for Transcript of Tax Return;

-

Dodd-Frank Certification — all borrowers must complete and sign the enclosed Dodd-Frank Certification.

All information provided will be used for the previously mentioned evaluation.

Is the Short Sale Information Packet accompanied by other forms?

IRS Form 4506T-EZ Request for Transcript of Tax Return must be submitted as a mandatory part of the Chase Short Sale Information Packet. For other documents, see the checklist on the second page of the form.

How do I fill out the Short Sale Information Packet?

The following parts of the form must be filled out in order to complete the Packet correctly:

-

Authorization to provide and release information;

-

Request for Consideration of Short Sale Form;

-

IRS Form 4506T-EZ Request for Transcript of Tax Return;

-

Dodd-Frank Certification.

To be valid, each part of this Short Sale Information Packet should be signed and dated by all persons related to the document.

Where do I send the Short Sale Information Packet?

Once completed and signed, this form along with all the attachments should be directed to the Chase Fulfillment Center. PO Box 469030 Glendale, CO 80246